Spot gold is trading slightly higher, but remains confined to last week’s range. A softer dollar is offering support, despite the most recent escalations of the trade war.

The Trump administration confirmed in an announcement on Monday that additional tariffs would be imposed on another $200 bln in imports from China on 24-Sep. Mr. Trump went on to say that the tariffs would rise to 25% on 01-Jan. The Chinese retaliated today by queuing up tariffs on $60 bln in U.S. products for the same date.

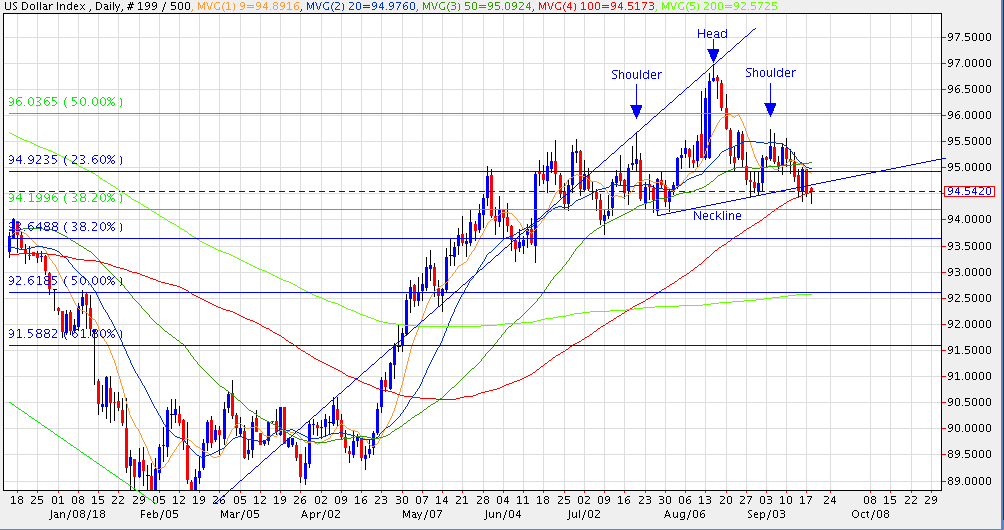

China’s response was more measured than anticipated, which is contributing to the easier dollar and firmer commodity prices. The dollar index slipped to a 7-week low at 94.31. This constituted a violation of the 100-day moving average (94.52 today), although downside follow-through has been limited thus far.

A close below the 100-day MA would target 94.08/00 initially, with potential to 93.65 (38.2% retracement of the rally from 88.25 to 96.98). A case can also be made for a head-and-shoulders top, which would have more negative technical implications.

Gold can’t seem to muster any upside momentum, leaving the price confined to last week’s range. The next technical hurdle is the 50-day moving average (1208.94 today), which now protects the recent corrective highs at 1212.66/1214.32.

Initial support at 1192.96/83 protects the more important 1187.77 low from 11-Sep. A short-term penetration of the latter would shift focus to the 61.8% retracement level of the recent corrective rally comes in at 1180.92.

It seems likely that gold will remain fairly well contained ahead of next week’s FOMC meeting, where the Fed is widely expected to nudge rates higher by another 25 bps. Focus will be on the policy statement, economic projections and Powell’s presser in the search for clues about policy intentions for December and into 2019.

Silver remains consolidative within last week’s range, after unsuccessfully retesting the 13.94 low on Friday. This leaves the 13.64 low from 14-Dec-15 protected for the time being. That being said, the trend remains decisively bearish at this point. A close above the 20-day moving average (14.38 today) is needed to ease short-term pressure on the downside.

Platinum has extended to the upside, establishing new 5-week highs. The convincing violation of the 50-day MA (807.90 today) and chart resistance at 813.11 brings the 830.00 target within striking distance.

Palladium finally took out chart resistance at 989.50/992.43, along with the 50-week and 200-day moving averages. Platinum has traded with a 1000-handle for the first time since 18-Jun.

The next level to be watching is 1023.06, which marks 61.8% retracement of the decline from 1139.62 (15-Jan high) to 832.15 (14-Aug low). Palladium has now rallied 21% off of that low, signaling a bull market.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.