Spot gold firmed to another 2-week high, buoyed by a weaker dollar. However, resistance at 1212.70/1214.32 successfully capped the upside, keeping the short-term bias neutral.

There have been reports of progress on trade negotiations between the U.S. and Canada. In addition, senior U.S. officials have reached out to China in an effort to restart trade talks. The easing of trade tensions this week has buoyed the broad commodity complex and taken some of the haven bid out of the dollar.

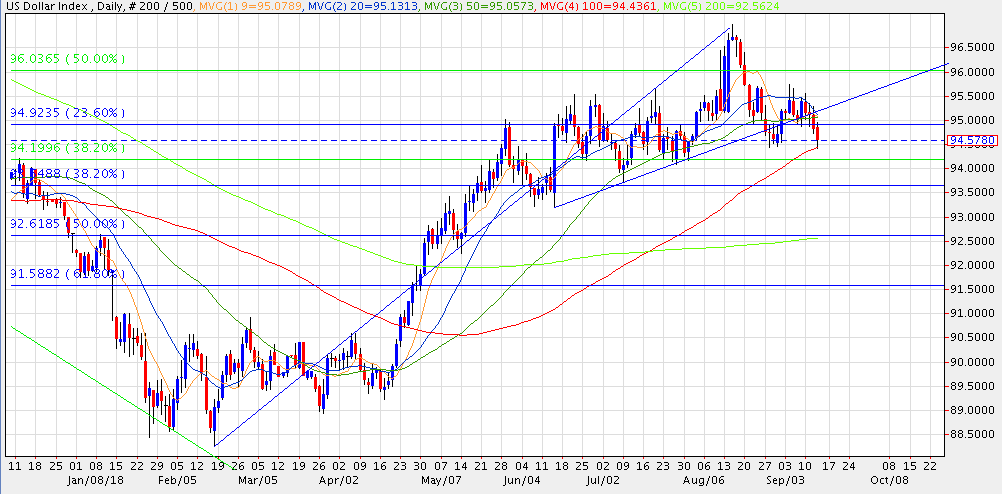

The dollar index eked out a new 6-week low below 94.43 (28-Aug low), which happened to correspond with the 100-day and 20-week moving averages today. A more convincing breach of this support level would shift focus to 94.14 initially, but would also lend additional credence to the scenario that suggests the dollar has topped and a more significant correction is imminent.

The dollar index is presently trading about 2.4% off the mid-August high, having completed just over a 50% retrace of the decline from 103.82 (03-Jan-17 high) to the 88.25 low (16-Feb-18). If the topping scenario plays out, I’d suggest potential is for a 50% retrace of this year’s rally, which would target 92.62.

Focus this morning has been on monetary policy. The Bank of England held steady on policy, which was in line with expectation. The ECB held steady on policy as well and confirmed the intent to start tapering asset purchases in October.

"After September 2018, the Governing Council will reduce the monthly pace of the net asset purchases to €15 billion until the end of December 2018 and anticipates that, subject to incoming data confirming the medium-term inflation outlook, net purchases will then end." — ECB Policy Statement

In the post-policy-decision press conference, ECB President Mario Draghi said that the central bank was now forecasting “significantly stronger core inflation.” This caught the market a little off guard, lifting the euro and gold.

Significantly stronger core inflation would likely incent the ECB to tighten more aggressively, narrowing the interest rate differential with the U.S. That would support the euro and potentially add further pressure to the dollar. And of course, gold is the classic hedge against inflation.

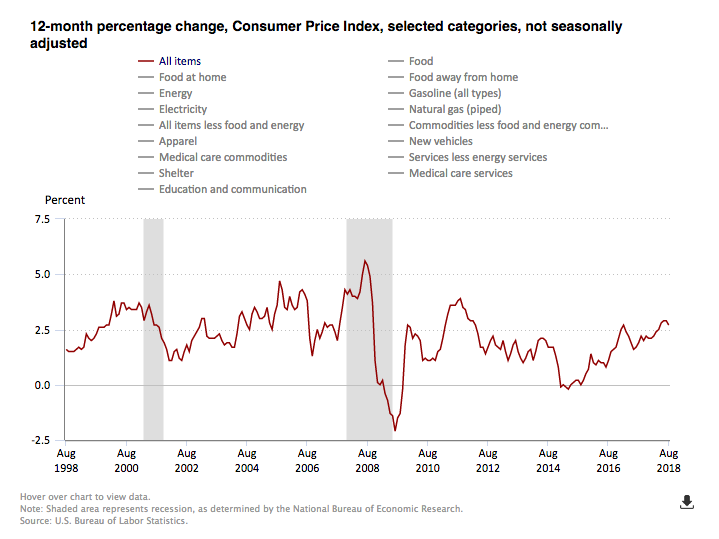

The U.S. Bureau of Labor Statistics released August CPI data this morning. U.S. CPI came in below expectations at +0.2% m/m, slowing the annual pace to 2.7% from 2.9% in July. Core CPI rose a scant 0.1% on expectations of +0.2%. Annualized core CPI slowed to 2.2% from 2.4% in July. This comes on the heels of yesterday’s softer than expected PPI data.

The 2.9% y/y print in July was a more than 6-year high, equaling the 2.9% reading from February 2012. The trend remains positive at this point, but the recent slow-down may temper expectations for a Fed rate hike in December. That too would likely weigh on the dollar and give a boost to gold.

Gold needs to take out resistance at 1212.70/1214.32 to provide some encouragement to the bulls. Perhaps more importantly, such a move would likely escalate the unease of the shorts. It is no secret that there is a massive short position in gold futures and the burning question is at what price level would the shorts start to cover.

That’s probably more in the 1230/1240 range, which would in fact be the objective on a breach of 1214.32. If a short-squeeze were to ensue, a return to the 1280/1300 zone would not be unreasonable.

Silver set a new 2-week high at 14.35 in earlier trading, before retreating back to the 9-day moving average (14.21 today). About the most positive thing you can say about silver at this point is that Tuesday’s drop to 31-month lows below $14 was short-lived.

Persistent strength in the gold/silver ratio continues to reflect the comparative weakness of silver. The Silver Institute reported yesterday that China is the world’s biggest consumer of silver, accounting for 18% of global demand. As the trade war with the U.S. has heated up this year, risks to growth in China have become more pronounced, which has in turn contributed to silver’s weakness.

Platinum jumped to a new 4-week high above 810.03 (28-Aug high). That constituted a probe above the 50-day moving average (810.48 today), something we haven’t seen since early-June. While platinum has retreated into the range, and the dominant trend remains negative, I see short-term potential to 830.00.

Palladium continues to consolidate just below the recent highs. The recent series of highs along with the 50-week (988.29 today) and 200-day (988.22 today) moving averages have developed into a formidable upside barrier. However, the chart pattern has the appearance of a continuation pattern, rather than a topping pattern. I continue to think palladium is going back above $1,000, particularly if efforts to restart trade negotiations between China and the U.S. prove successful.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.