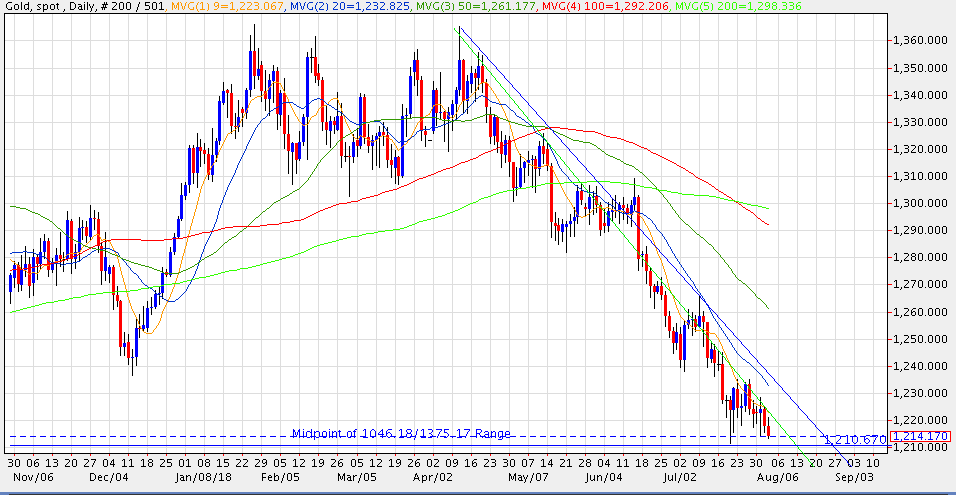

Spot gold has slipped to another two-week low, pressuring the cycle low at 1211.52. The yellow metal is being pressured by soft Q2 demand data from the WGC, as well as a firmer dollar.

The World Gold Council released their Gold Demand Trends report for Q2 today. The WGC reported that overall demand slipped 4% in Q2 to 964.3 tonnes. Total for the first half of the year was 1,959.9 tonnes, the lowest since 2009.

The WGC highlighted slower ETF inflows and central bank buying, as well as soft jewelry demand (particularly in India). Meanwhile, bar and coin demand was little changed and technology related demand expanded for a seventh consecutive quarter.

Given the demand picture, and the fact that the gold supply rose 3% in Q2, it’s perhaps not surprising that the yellow metal was under pressure from April to June. Now that we’re a third of the way through Q3, the burning question becomes: Where is gold headed in the second half of the year?

The fact that key support at 1211.52/1204.72 is intact, offers some encouragement. We also tend to see a positive seasonal influence emerge in late summer.

We’re certainly not seeing that seasonal buying yet and gold has struggled to sustain even modest upticks in the face of rather bearish sentiment. This market may need to wash-out the weak longs and run the stops below $1200 before finding the footing from which to start a rally.

The 9-day moving average at 1223.31 marks initial resistance. We haven’t seen a close above this MA since last Wednesday, reflecting the short-term weakness. A close above the 20-day MA (1232.93 today) is still needed to provide a glimmer of hope that a bottom is in place. Intervening resistance is marked by Monday’s high at 1228.59.

The Fed held steady on rates yesterday, as was widely expected. However, the policy statement was quite optimistic about the economic performance in Q2. That makes a September rate hike all-but a sure thing. The CME’s FedWatch tool puts the probability at 93.6% this morning. The prospects for a December rate hike are approaching 70%.

The BoE raised rates by 25 bps earlier today. It was just the second rate hike in more than a decade. The first since July of 2007 occurred back in November of last year.

This too was widely expected, but the unanimous 9-0 vote to hike was a surprise. The BoE cautioned, "Any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent."

While sterling rose initially, the market quickly assessed that any follow-on tightening was probably quite distant. Cable gave back all its earlier gains and then some. That provided some additional buoyancy to the dollar.

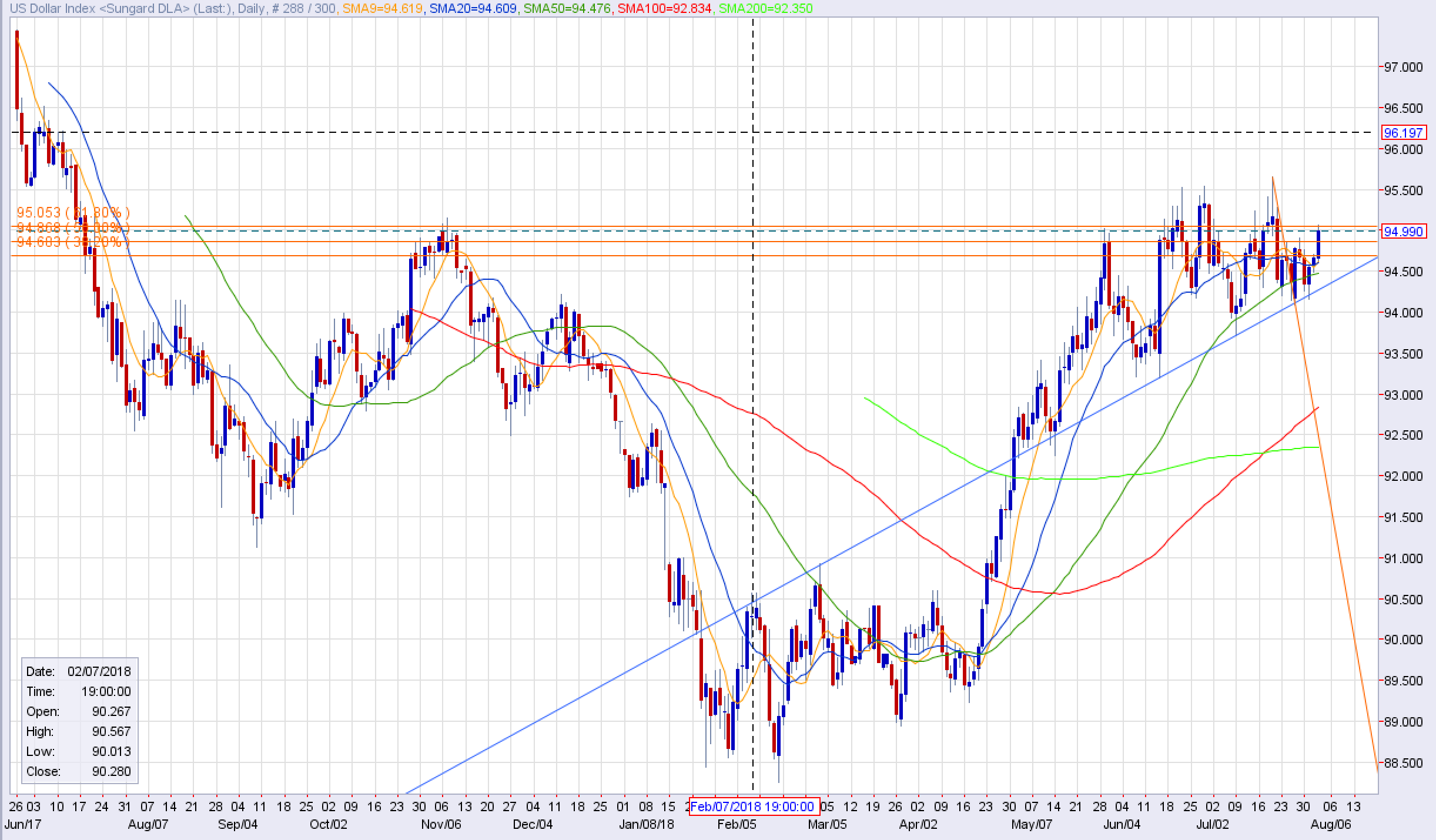

The dollar index is up for a third consecutive session, underpinned by the latest escalation of trade tensions between the U.S. and China. The 61.8% retracement level of the decline off the 95.65 high (19-Jul) has been tested at 95.05, but remains intact thus far. A convincing penetration would return a measure of credence to the underlying uptrend, putting the 95.52/65 highs back in play and applying some additional pressure to precious metals.

Focus now shifts fully to tomorrow’s U.S. jobs data for July. Median expectations for nonfarm payrolls is +187k, although yesterday’s robust ADP data has resulted in whispers of another print above 200k. The unemployment rate is expected to tick back down to 3.9%.

Silver remains generally consolidative within the recent range. An inside day is evident. Recent price action has resulted in what appears to be some type of continuation patter; either a bear flag or perhaps a symmetrical triangle. As long as silver remains below 15.62/66 (20-day MA and 26-Jul high), we consider the downside vulnerable.

Platinum and palladium both set new lows for the week in earlier trade, but are now higher on the day, despite the heightened trade concerns. Choppy trade in the PMG is likely to prevail until gold and silver pick a direction.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.