Spot gold fell in overseas trading to establish a new low for the week at 1217.58. While the yellow metal has since rebounded to trade near unchanged on the day, a close above 1231.69 is needed to avert a third consecutive lower weekly close.

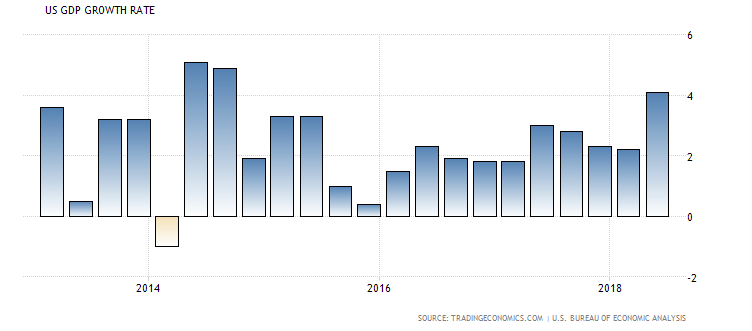

U.S. advance Q2 GDP came in at a solid 4.1%. That was in line with expectations, but below the whisper. Nonetheless, that’s a solid number, the highest since Q3-14 and a solid increase over the upward revised 2.2% growth seen in the first three months of this year.

Markets seem nonplussed largely because today’s print was in line with expectations. However, the prevailing trends are likely to persist.

Rate hike expectations are likely to remain elevated as well, favoring 25 bps hikes in both September and December. Next week’s FOMC meeting may provide some additional clarity on that matter.

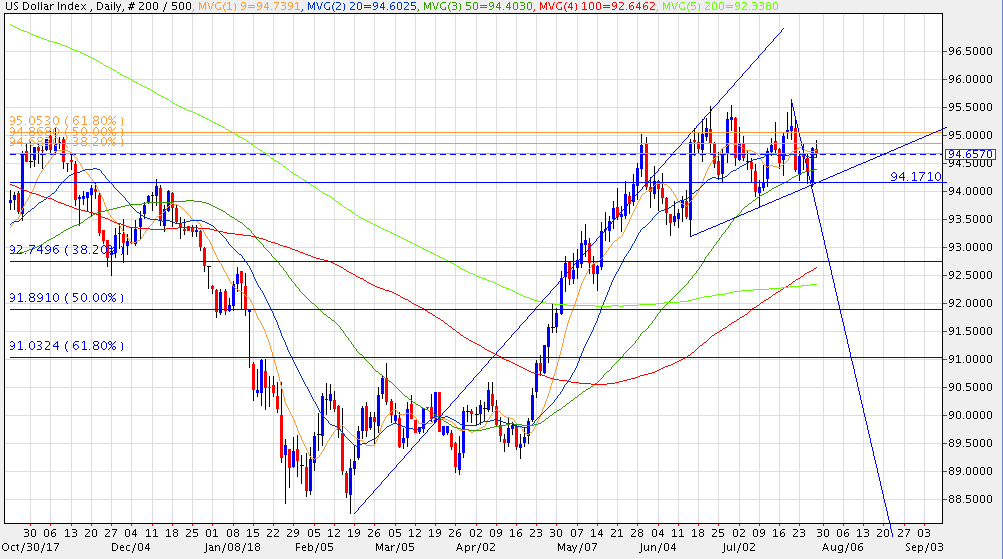

Those next two rate hikes are priced into the dollar, so greenback seems unsure where to go from here. After rallying smartly yesterday, the dollar index has faltered intraday.

Slightly more than 50% of the recent correction has been retraced and the DX is still likely to close higher on the week. However, the dollar chart continues to look toppy with tests of the upside over the past several weeks limited by the 100- and 200-week moving averages.

If the dollar is indeed topping out, it would remove what has arguably been gold’s biggest headwind since April. That would suggest the summer doldrums for the precious metals complex could be coming to an end, just about on schedule.

Gold’s disappointing close on Thursday leaves the yellow metal vulnerable. We’ll continue to watch the 9-day MA (1226.75) on a close basis for short-term directional queues, but a close above the 20-day MA (1239.56) is still needed lend some credence to a bottoming scenario ahead of key support marked by the 1204.72 low from last July. Intervening support is noted at 1211.52/1201.57, last week’s low and the midpoint of the 1046.18/1375.17 range.

Silver needs to close above 15.48 to avert a seventh consecutive lower weekly close. Overseas downticks in silver were successfully contained by Monday’s low at 15.32. While silver has returned to its 9-day MA 15.48 (which happens to coincide with yesterday’s close), here too we’re looking for a close above the 20-day MA (15.74) to ease pressure on the downside. Such a move would bode well for a return to the $16 zone.

Platinum and palladium closed above their 20-day MA earlier in the week, which failed to illicit much in the way of upside follow-through. Perhaps the PGMs are just waiting for the more important gold and silver markets to make a similar move. The subsequent retreats leave the PMGs in neutral territory, but the trends remain negative.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.