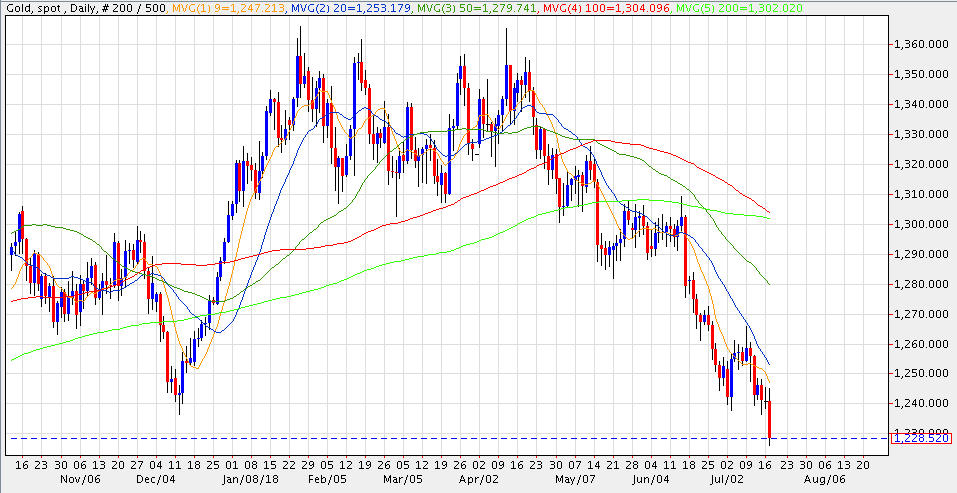

Spot gold has convincingly negated the key 1237.93/1236.45 support level (03-Jul, 12-Dec-17 lows), with rather bearish technical implications. The yellow metal is off nearly 1% on the day and trading at levels not seen since last July.

The next significant support level is the 1204.72 low from 10-Jul-17. While the market is becoming quite oversold on a very short-term basis, any rebound would likely be viewed as a selling opportunity ahead of the 20-day moving average (1253.17). Initial resistance is marked by previous support at 1236.45/1237.93. The overseas high at 1245.00 is bolstered by the 9-day MA at 1247.19.

Fed Chairman Powell’s prepared testimony before the Senate Banking Committee was quite optimistic. “With a strong job market, inflation close to our objective, and the risks to the outlook roughly balanced, the FOMC believes that--for now--the best way forward is to keep gradually raising the federal funds rate."

The rebound in industrial production seen in June added to the economic euphoria, boosting expectations for a fourth rate hike this year. This has buoyed the dollar.

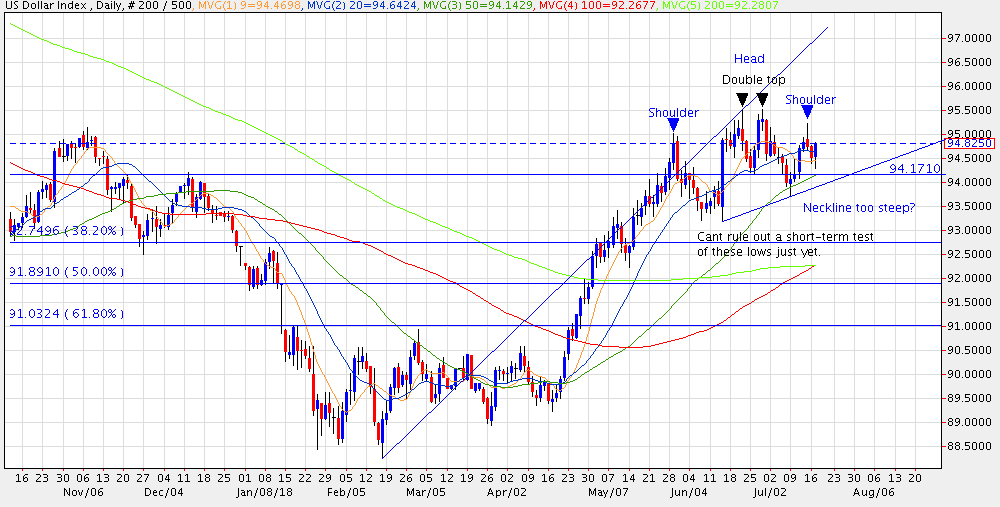

Gold had not garnered any support from the previous two sessions of dollar losses, but today’s bounce is certainly weighing on the metals. The dominant feature on the dollar index chart remains the double top. A case can be made for a head-and-shoulders formation as well, but I don’t like the steepness of the neckline.

While the DX still looks toppy, today’s outside day puts this scenario in jeopardy. A close above the 20-day moving average at 94.64 would further erode confidence. If the dominant uptrend in the dollar is to resume, that does not bode well for the precious metals.

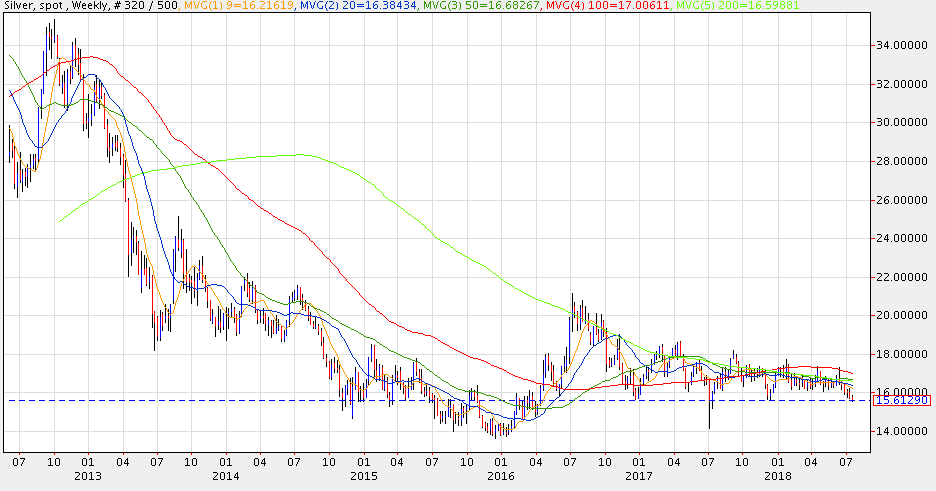

Silver has negated key support at 15.61 (12-Dec-17 low), establishing new 1-year lows. The breakout of the range that has dominated since late last year is a negative event, suggesting potential to the 14.16 spike low from July of last year. The weekly chart below provides some perspective.

Here too however, an oversold situation has developed and silver has moved off the intraday lows. Upticks are likely to be viewed as selling opportunities ahead of the 9-day MA (15.90). More important resistance at 15.99/16.04 defines short-term risk.

Platinum continues to trend lower with expectations for renewed probes below $800. A breach of the early-July low at 796.89 would keep focus squarely on the downside with potential to the financial crisis low at 732.50 from October 2008.

Palladium has extended to the downside in the wake of yesterday’s breach of support at 930.25. Palladium moved within $10 of the targeted 896.50 low from April. Previous support at 930.25 now marks initial resistance.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.