Spot gold is narrowly confined to start the week, trading well within Friday’s range. However, the downside remains vulnerable amid ongoing trade war worries and ETF outflows.

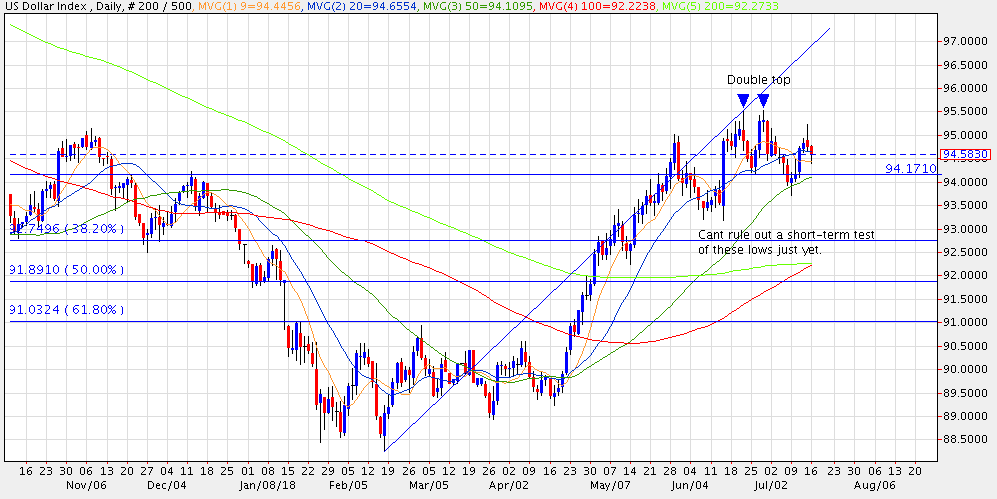

A softer dollar this morning is not providing much in the way of support for the precious metals. Gains in the dollar index in the latter half of last week stalled well shy of the 95.53 double top. The DX has retreated to its 9-day moving average (94.44 today) would suggest potential for another run at the 50-day MA (94.11). Below the latter, solid chart support is defined by last Monday’s low at 93.71.

Markets are trying to hash out whether a trade war is an inflationary or deflationary event. There is perhaps a growing expectation that the Fed may temper recent hawkishness if the trade war continues to escalate. If the prospects for a fourth rate hike this year lessen, so too will a significant tailwind for the dollar.

If growth risks rise, the Fed would likely take a more dovish bent going into year-end, regardless of rising inflation risks. At this point however, a September rate hike is largely baked into the cake and Fed funds futures suggest the potential for a December hike to be a better than 50/50 proposition.

With inflation already accelerating, one has to wonder when gold might reassume its role as an inflation hedge. And with wages lagging, there is heightened talk of potential stagflation as well.

That kind of support for gold has yet to materialize. Friday saw the yellow metal slightly exceed the key 1237.93/1236.45 support level (03-Jul, 12-Dec-17 lows). That resulted in a new 12-month low. A more convincing breach of this level would leave the 1204.72 low from 10-Jul-17 vulnerable to a challenge.

Minor chart resistance at 1248.13/59 protects the 9-day MA at 1250.44. However, gold really needs to score a close above the 20-day MA (1255.53) to ease short-term pressure on the downside. Such a move would favor a retest of the corrective high at 1265.89 (09-Jul high).

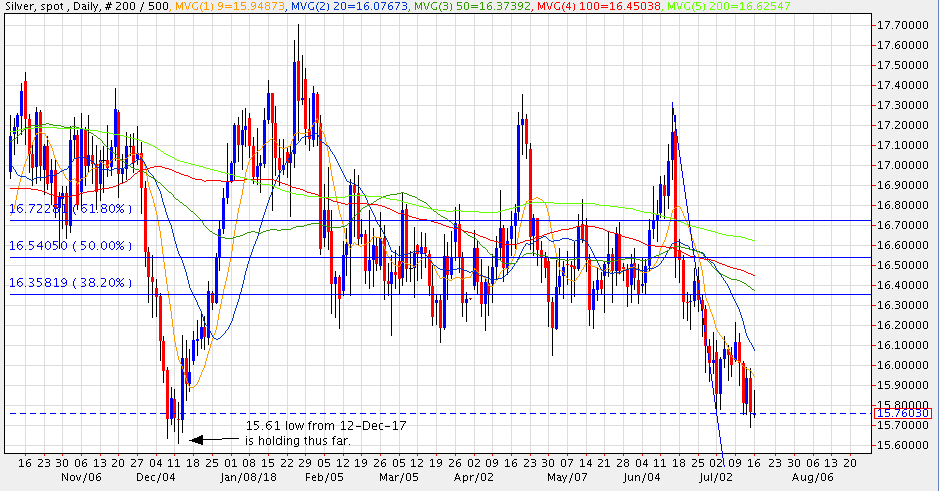

Silver has stabilized somewhat after pressuring key support at 15.61 (12-Dec low) on Friday. While this level has contained the downside thus far, further tests cannot be ruled out. Here too, a close above the 20-day MA (16.08 today) is needed to ease short-term pressure on the downside and lend some credence to a bottoming scenario.

Initial resistance is marked by the intraday high at 15.87. The 9-day MA comes in at 15.95 and minor chart resistance is noted at 15.99/16.00.

Platinum remains on the defensive with scope seen for further tests below $800. More than 61.8% of the recent corrective rally has now been retraced, lending additional credence to the scenario that favors a retest of the 796.89 low from 03-Jul.

Palladium has negated support at 930.25, establishing fresh 13-week lows. The path has been cleared for a retest of the April low at 896.50.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.