Spot gold is little changed this morning, despite an easier dollar. Markets are awaiting the release of the minutes of the most recent FOMC meeting and looking ahead to tomorrow’s jobs report.

As usual, market participants are keen to get any additional insights on likely Fed policy moves in the second half of the year. There was a pretty strong indication in the policy statement that two more rate hikes were likely this year. We’ll see if the minutes confirm that conviction.

While odds of another 25 bps rate hike in September are running close to 80%, the CME’s FedWatch tool suggests there is still some skepticism about a December hike. The market sees a December hike as about a 50/50 proposition right now.

Tomorrow we’ll get June payrolls data. Median expectations for nonfarm payrolls are 191k. The unemployment rate is expected to hold steady at 3.8%.

The ADP employment survey that came out this morning missed expectations. A gain of 185k jobs was expected for June, the reality was +177k. However, May was revised up to +189k, versus +178k previously.

Of course the developing trade war remains the top fundamental factor impacting markets. The U.S. plans to implement 434 bln in tariffs on Chinese goods beginning tomorrow. China has vowed to retaliate, so we’ll all be watching to see how the situation might escalate in the days and weeks ahead.

This has weighed on global shares, but there hasn’t been much flight to safety into the metals. However, if the trade war does indeed escalate — and in particular if inflation accelerates as a result — the metals may eventually reclaim their safe-haven status.

Gold saw a nice rebound over the past two holiday shortened sessions. The yellow metal formed a key reversal on Tuesday and then extended to a one week high of 1261.11 yesterday. The close above the 9-day moving average offers further encouragement.

Another new high for the week would suggest potential back to minor chart resistance at 1272.60. This level corresponds closely with the 20-day moving average.

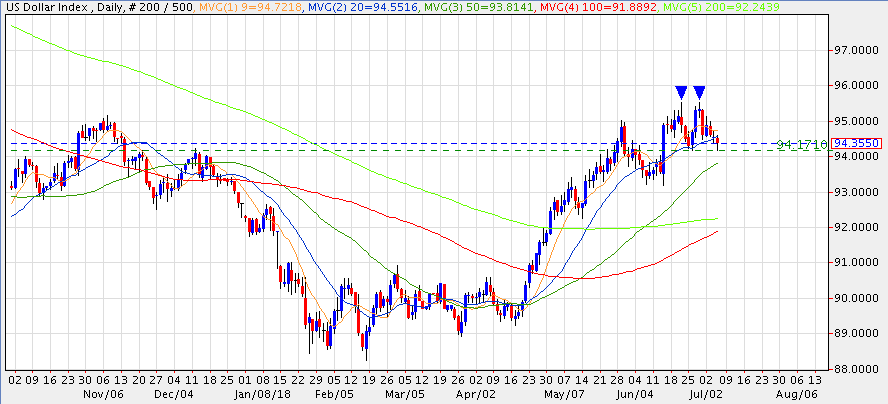

The confirmation point of the double top in the dollar index at 94.17 was tested today. While this level has contained the downside thus far, if it were to give way, the 95.53 double top (21-Jun and 28-Jun highs) would be confirmed.

Such a move would suggest downside potential to the 93.21/19 level. A close below the 20-day moving average today (94.55) would lend credence to this short-term negative outlook.

A weaker dollar would likely provide a tailwind for gold. On the other hand, if the DX holds support and gold fails to sustain gains above the 9-day MA on a close basis, another run at the key 1237.97/1236.41 support level would have to be considered.

Silver is flirting with its 9-day MA as well (16.09 today). A close above this level and a breach of minor chart resistance at 16.16 would bode well for further retracement. Focus at that point would shift to the 38.2% retracement level of the June high, which comes in at 16.36.

For now, focus remains on the downside, with scope still seen for a true test of the 15.61 low from 12-Dec-17. Monday’s low at 15.76 provides good intervening support. However, the more constructive chart pattern in gold warrants an additional measure of caution here.

Platinum continues to recover from its 10-year low below $800 on Tuesday, although momentum has slowed over the most recent two sessions. It’s hard to be anything other than bearish this market. The 2008 low at 732.50 is the likely attraction, with Tuesday’s low at 796.89 providing an intervening barrier. Initial resistance is at 852.97/854.37.

Palladium continues to consolidate within the recent range. A symmetrical triangle seems to be forming and we would anticipate a breakout to the downside. A measuring objective off of this continuation pattern would correspond pretty closely to the 896.50 low from 06-Apr.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.