Spot gold is rebounding after setting a 6-month low at 1237.97. The yellow metal is being helped by a softer dollar and profit taking ahead of the midweek U.S. holiday.

U.S. markets are closing early today and will be closed Wednesday, 04-Jul in observance of Independence Day. The U.S. economic calendar is light today with May factory orders and June auto sales.

Trade war fears continue to be the driving force behind the markets. Today’s rebound in gold may in part be reflective of an eroding belief that the U.S. has the least to lose in a trade war.

The U.S. Chamber of Commerce came out strongly in opposition to the Trump Administration’s trade policies. Chamber President Tom Donohue told Reuters that “the administration is threatening to undermine the economic progress it worked so hard to achieve.”

One thing is certain, tariffs drive up the end cost paid by the consumers of imported goods; and no country consumes more imported goods than the U.S. A Jefferies analyst pointed out that apparel and footwear are particularly vulnerable segments.

As inflation gets stoked and risks to growth are heightened, the Fed may have to adopt a more dovish tone. That could lead to an unwinding of long dollar positions, which would in turn provide a tailwind for gold.

There is already a potential double top evident in the dollar index at 95.53 (21-Jun and 28-Jun highs). The confirmation point of that bearish chart formation is at 94.17 (26-Jun low). A breach of intervening support at 94.47 would put 94.17 in play.

Gold pressured key chart support at 1236.41 (12-Dec-17 low) in overseas trading before catching a bid. While it’s too early to suggest that a bottom is in place, gold is holding right where it needed to . . . at least for the time being. Risk is clearly defined below 1236.31/1233.70.

A rebound above Friday’s high at 1255.51 would offer some encouragement to the bull camp, shifting focus to the 20-day moving average at 1274.76. A short-term close above the latter would lend some credence to a bottoming scenario and suggest potential back to the 1300.00 zone.

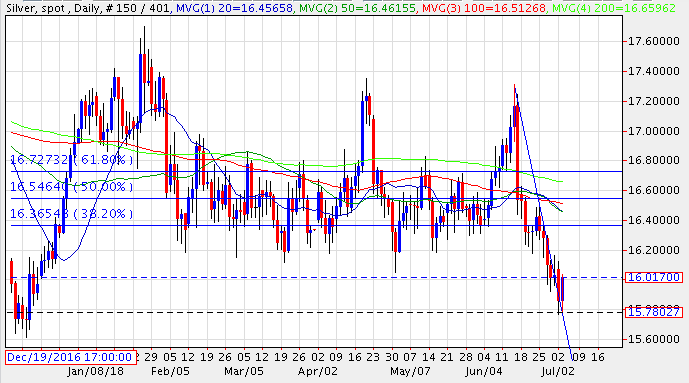

Silver has regained the 16-handle once again, but minor resistance at 16.16 must be cleared to ease short-term pressure on the downside. Such a move seems unlikely ahead of today’s early close.

At this point, a downside extension to challenge the 15.61 low from 12-Dec-17 cannot be ruled out. Monday’s low at 15.76 now provides good intervening support.

Platinum tumbled through key support at 810.30 to set new 10-year lows in overseas trading. However, losses below $800 could not be sustained and platinum is now more than $40 (5.5%) off the 794.49 intraday low.

Palladium remains comparatively well contained within the recent range. Friday’s low at 929.32 was pressured, but successfully contained the downside. Nonetheless, the downside remains vulnerable as long as resistance at 960.42 is intact.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Group LLC, unless otherwise expressly noted.